|

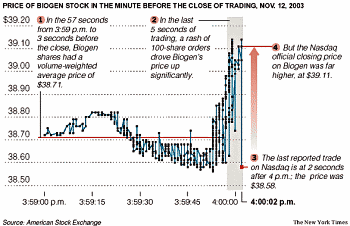

How do you set the closing price of a stock? You'd think it would be

simple: the last trade of the day. But in a

decentralized

electronic market like NASDAQ there's no single auction, no single

price. Today's NYT has a clear

article explaining the problems that arise. The S&P 500 is

experimenting with switching away from NASDAQ to the

American Stock Exchange to set

closing prices. AMEX is a traditional

centralized human-mediated market; a single

specialist making book means you have a single price.

The fascinating story here is the manipulation of closing process by

"spraying":

a series of minimally sized

orders, e.g., 100 shares, immediately prior to the open or close that,

based on the amount of displayed size, outstrips

short-term liquidity and creates excessive price movement on a

temporary basis

By jamming in a bunch of orders at the last second you can

force a price swing. Why would you do that? Because a lot of

compound securities are pegged to the closing price of individual

stocks on NASDAQ. Crazy!

According to NASDAQ Head Trader Alert #2003-093 they have some quantitative process to detect spraying; when they find it, they take an average price from the last 15-30 seconds. Another interesting nugget is AMEX's memo to the SEC in November 2003. It's in response to NASDAQ trying to block the S&P change, basically explaining that this is a good change and AMEX has no say in it anyway. The real problem is the notion of a 'closing price' at all. Why not trade 24 hours a day? It will happen soon enough. The world gets faster. |

||